Quarterly Commentary 2Q’21

Sunshiny Days

Markets continued to deliver strong gains for investors in the 2nd Quarter of 2021. The global MSCI All Country World Index was up 7.5% for the quarter and 13.3% year to date through June 30, 2021. The US-based S&P 500 was up even more, 8.6% for the quarter and 15.3% year-to-date. Investors and consumers alike are showing a lot of confidence as economies in the US and elsewhere recover at a very strong clip (global GDP growth is 5%+). Covid vaccinations are proceeding, workers are headed back to the office, and increasingly assured consumers are headed back to stores and onto airplanes.

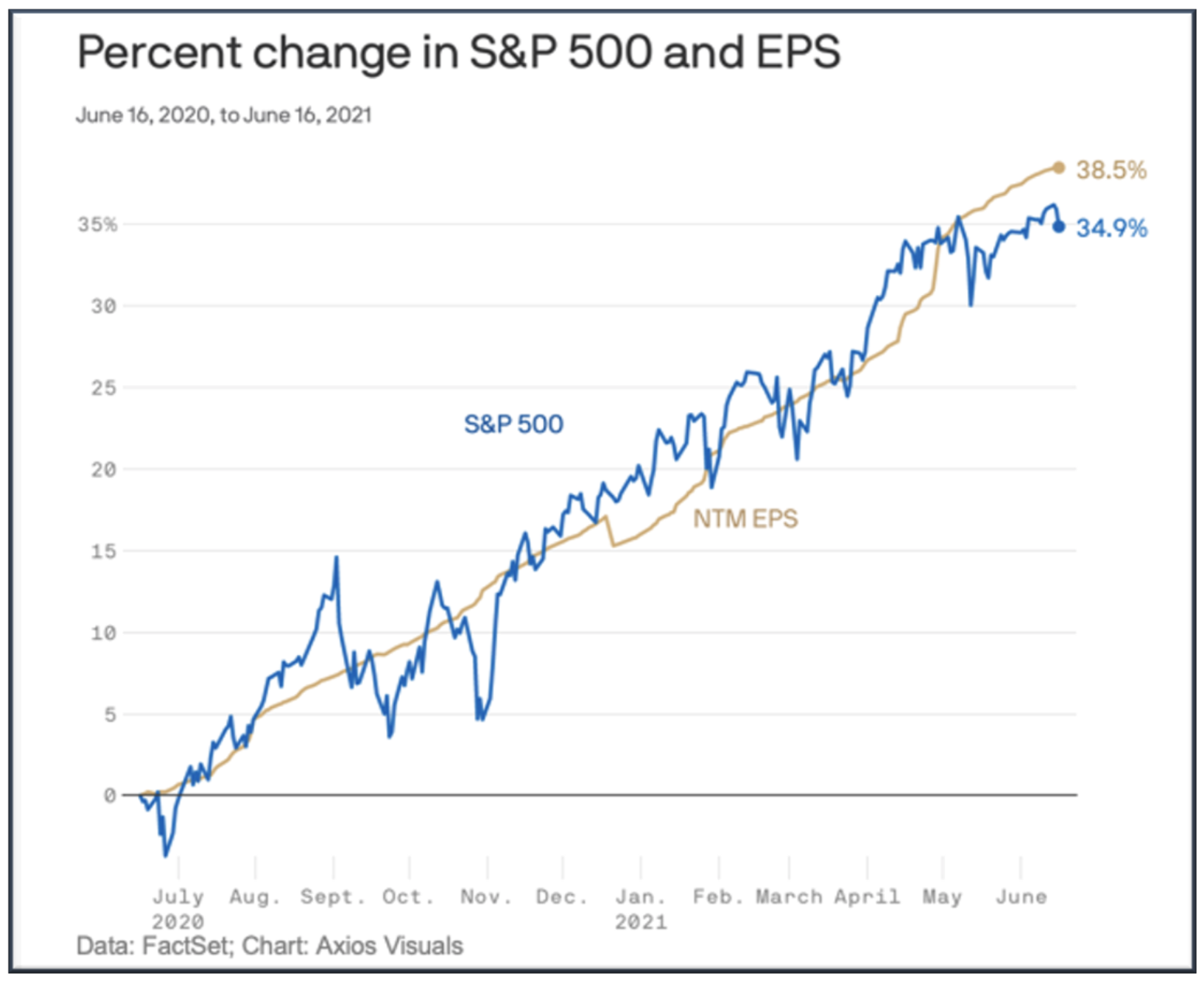

The rise in stocks has been essentially unabated since the low point of March 2020. The S&P 500 is now trading at 21x forward 12-month earnings projections vs. the historic average of 16-17x but this premium may well be justified by the combination of low interest rates and strong earnings growth. While the economy and the markets are not the same thing, it’s validating to see stock prices rising in tandem with robust earnings growth (see chart). Figure 8 stock portfolios have performed largely in line with markets, even with the headwind of rebounding oil - which we expect will be temporary as the transition away from fossil fuels continues.

Of course, there remain significant risks to this rosy outlook, the most pressing of which continues to be the coronavirus. Global vaccination rates are still low, deaths are still high, and new variants like Delta pose unknown risks. Even as the US economy reopens, it’s unclear how the virus will play out over coming months and years. Other looming risks to economic stability include a slew of recent cybercrimes, an increasingly aggressive China, and the possibility of rising inflation (more below).

We’re also facing turmoil in what we’ve typically relied on as routine activities in more normal times. We’d predicted supply chain disruptions when the pandemic first hit, although not necessarily as part of the recovery phase. Now, with rapidly rising consumer demand for things like cars and appliances, we’re seeing imbalances that in some cases are quite dramatic. It’s hard to tell if this will persist and if so, how companies will navigate.

The supply of labor may be most confusing of all. Labor markets are in major flux, with worker shortages and upward wage pressure, while many remain out of work. Since the pandemic hit, the labor force has shrunk by more than 3 million people, from its February 2020 high of 164.6 million, while the labor force participation rate – that is, those not actively looking for work -- has stayed low at around 61%. The official unemployment rate of 5.9% is almost certainly undercounting. Some pundits point to reliance on pandemic benefits as a disincentive to work, but we see other forces at play. One is that women account for a disproportionate chunk of the decrease in labor force participation, as many have stayed home to care for children unable to attend schools and camps over the past year. Another explanation is that Covid itself could account for significant declines in the size of the labor force. Of the more than 600,000 Americans who’ve died from Covid, many were elderly but roughly a quarter were working age. Additionally, The New England Journal of Medicine estimates that as many as 15 million Americans may suffer from “long-haul Covid” with persistent symptoms that may make work difficult or impossible. Once again, it’s unclear how this plays out, in both the U.S. and beyond. We’ll know more in September when federal pandemic-related benefits lapse and kids go back to school, enabling parents – especially mothers – to return to the labor force.

In tandem with the shortages of labor and raw materials, costs have been rising leading to concerns about whether this inflation will be transitory or lasting. The Consumer Price Index was up 5% for May (from a year ago), leading the Federal Reserve to say it’s now projecting a rate hike in 2023 or possibly late 2022. Bond investors still do not believe persistent inflation is coming. In fact, longer-term rates in the bond market actually went down – not up – in recent weeks, with the benchmark 10-year Treasury dropping as low as 1.25%. We remain in the camp that sees recent inflationary forces as likely to be temporary – but we also know inflation is very tricky to predict and so we will be keeping an especially close eye on inflation-related dynamics.

Financial Activists on Fire

The 2021 proxy season is shaping up to be like no other. Year to date, 435 shareholder proposals have been filed with companies around critical ESG (environmental, social, and/or governance) issues, including climate change, racial justice, political contributions, and human rights. In years past, shareholder resolutions were considered “successful” if they received votes approaching double digits (e.g., 10%+) and large asset managers like Blackrock were rarely among the supporting votes, typically voting “with management”. Indeed, Figure 8’s been among those activist investors pushing Blackrock and others to use their clout to improve the corporate management of climate risks.

Last year we wrote here about the hypocrisy of large asset managers refusing to support climate-related resolutions even while touting pro-environment rhetoric. As evidence, we cited Blackrock’s 2020 support for only 3 of 36 important climate-related resolutions in spite of CEO Larry Fink’s annual letter declaring that “climate risk is investment risk.” We also wrote that in at least 15 cases, if Blackrock and Vanguard alone had voted for the proposals, it would have tipped the balance to majority support.

And THAT is exactly what appears to be happening in 2021. So far, a record-setting 34 ESG-related resolutions have received majority votes, 8 of those directly on climate and another 14 on political activity often pertaining to climate. In the case of Exxon, a push by activist investor Engine 1 with support from – yes! – Blackrock and Vanguard led to the election of 3 new climate-friendly board members, an unprecedented event. Now the question is: how will companies respond to the clear and overwhelming interests of their shareholders? Figure 8 and a growing crowd of concerned investors will be there to hold corporate management accountable for upping their response to climate challenges. There’s no time to waste.