Quarterly Commentary 2Q’24

Positivity Continued

As we enter the second half of 2024, key indicators confirm a theme of continued U.S. economic strength and resilience is very much intact. Consumers keep on spending, the jobs picture remains robust, and overall US GDP growth came in stronger than expected, at 2.8% for the 2nd Quarter. Inflation’s now been stable for more than a year, at around 3%, and interest rates have stayed in check. At this point, it is becoming clear that the combination of Federal Reserve actions and Federal government fiscal policy were successful in jumpstarting a post-pandemic economic revival, and then engineering a soft landing that’s kept the economy from overheating. Of course, there are still jitters and questions about where things go from here. Consumer debt levels have been rising alongside all that spending. Hiring, while still very healthy, has moderated to about 10% lower than a year ago.

Commercial real estate remains under pressure from higher interest rates and is unlikely to recover until the Fed begins a new cycle of rate cuts.

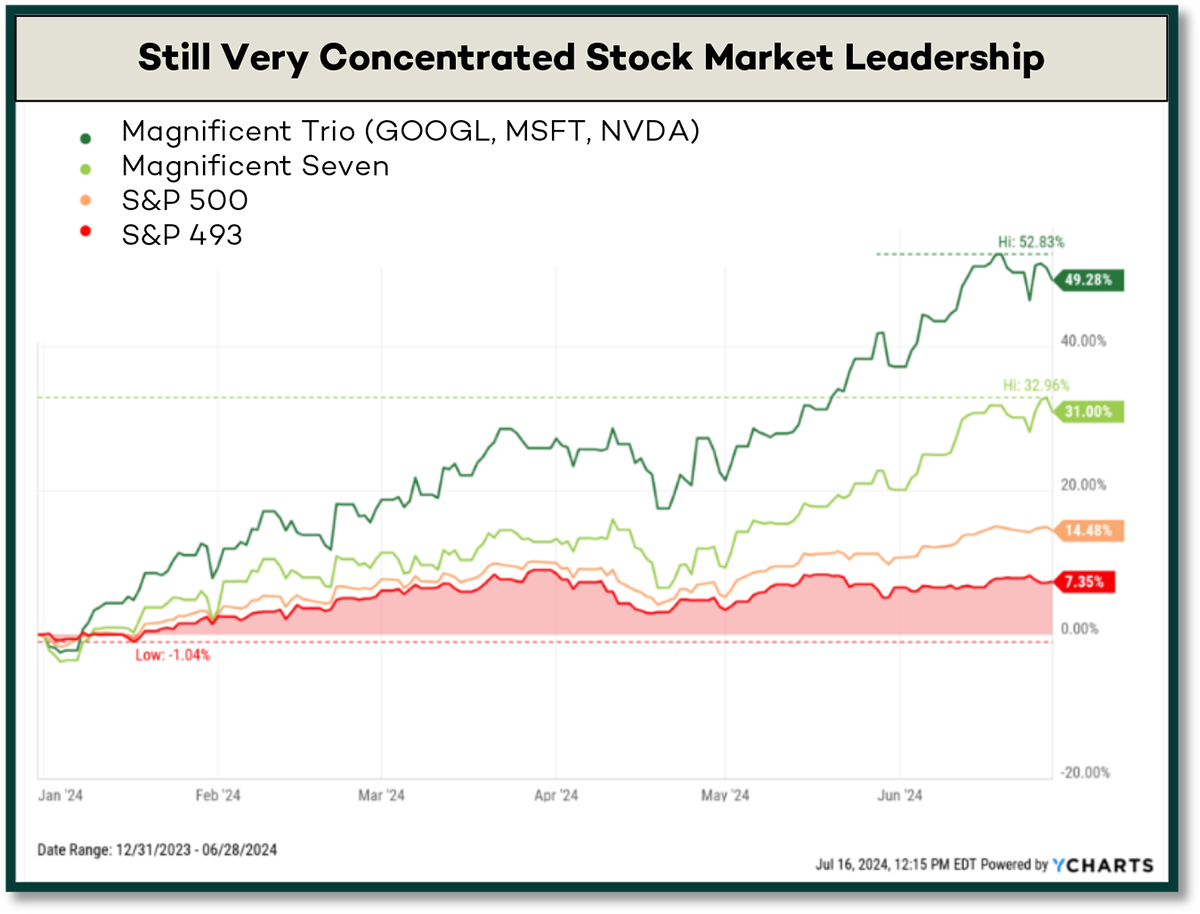

Markets have performed in sync with this economic optimism, delivering a solid 2nd quarter and capping a strong first half of 2024. The US-based S&P 500 was up roughly 4% for the 2nd quarter and 14% year-to-date while the global MSCI ACWI was up roughly 3% and 12% for the same periods.* As you can see in the chart at right, overall 2024 market returns have once again been driven by the largest capitalization US stocks, in particular the “Magnificent 7” tech stocks. In fact, just three (!) large tech stocks – Google, Microsoft, and Nvidia – have accounted for roughly half of the S&P 500’s return year-to-date.

Stocks linked to the clean energy transition – First Solar, Schneider, Trane Technologies – have performed particularly well this year to date, as have Taiwan Semiconductor and other chipmakers, driven by the promise of generative AI. Nike’s been especially weak, on anticipated consumer softening – something that so far has only been anticipated but not yet observed. Bond returns were roughly flat for the quarter, with the Bloomberg Barclays Aggregate Bond Index returning 0.7% as investors continued to anticipate the Fed’s future rate cuts (or not, depending on the day). During the quarter we added to positions in glass specialist Corning, attractively valued and poised to benefit from both clean energy and AI trends. We sold remaining shares of Autodesk on concerns about its accounting methods and transparency.

While the very largest US tech names (e.g., Apple, Microsoft, Google, Nvidia) have continued to lead performance, markets are now watching for a rotation away from them. We see this as healthy. Investors are recognizing there are lots of other investment opportunities to invest in well-run companies with strong balance sheets, promising growth outlooks, and considerably more attractive valuations than big-cap tech. Smaller capitalization US stocks and international stocks all look relatively attractive.

It’s also worth noting that the growth in AI fueling those big tech gains comes at a price, with huge new power demands – so much so that Microsoft and Google have both had their greenhouse gas emissions soar by 30%+ in the past year. Both companies have confirmed their commitments to longer-term net zero goals, but the current trend merits watching and holding key players accountable.

Shareholder Meeting Season 2024

Each year, engaged shareholders file proposals with companies asking them to address corporate practices around key environmental, social, and governance (ESG) issues (see chart at right). Many of these proposals go to a vote during the spring “proxy season” when most corporate annual meetings are held. Ideally, the shareholder proposal process leads to changes that align the long-term best interests of society, the planet, and shareholders.

Some of the most meaningful progress happens behind the scenes, when productive engagements between shareholders and corporate executives result in agreements for action and withdrawal of the resolution. For example, a 2024 resolution addressing “apparel circularity” was withdrawn at Nike, VF Corp, and Lululemon after successful dialogue led to all three companies committing to disclosure and supplier engagement around microfiber shedding, and to collaboratively developing new methodologies to mitigate plastic microfiber pollution.

So far in 2024, 600+ ESG-related proposals have been filed, with many resulting in exactly this type of agreement and withdrawal. In spite of the rising public attention to anti-ESG politicking, it’s clear that shareholder power around ESG initiatives is alive and well. Here are some highlights from Figure 8’s 2024 proxy season:

• Figure 8 voted proxies on clients’ behalf at 162 companies this spring.

• This included votes on 74 environment-focused proposals on issues like GHG emission reductions and protecting biodiversity. New environmental resolutions this year asked for a moratorium on deep sea mining from GM and Tesla, and for an assessment of the climate risks inherent in retirement plan options at Microsoft and Netflix.

• Our voting also included 99 proposals related to social issues including gender and racial pay gaps, preventing forced and child labor, and freedom of association for workers.

Shareholder campaigns take time – sometimes years – to see results. While not always seemingly “successful” in the near term, even small shareholder votes have proven to have impact over time. n the face of a changing legal and regulatory landscape – e.g., the Supreme Court’s recent overturning of “Chevron deference” – shareholder advocacy may be more important than ever. Watch this space for updates on shareholder campaigns, and news of changes to corporate policies and practices. We are in this for the long term.

* Source for Stock Index Returns: Refinitiv Datastream; Source for Bond Index Returns: The Wall Street JournalYou should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.