Quarterly Commentary 2Q’22

There’s no getting around it: 2022 has been rough so far. Stubbornly high inflation, continued supply chain disruptions, the ongoing war in Ukraine, multiple mass shootings in our schools and neighborhoods, and a wildly politicized activist right-wing Supreme Court, have created hard times for markets, our country, and the world.

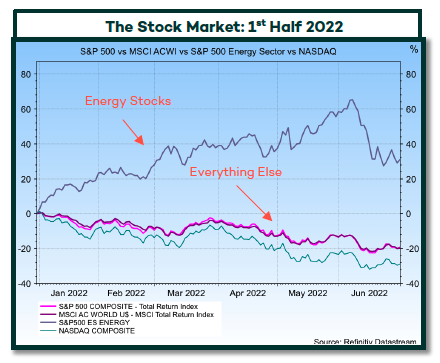

First, let’s look at the markets. As indicated in the chart below, all the major stock indexes are now in bear market territory –down 20% or more from their January high points. Growth-oriented stocks have suffered, but the market pullback has been widespread and nearly every sector has suffered declines (with the notable exception of oil and gas stocks). As interest rates have increased, bonds have also struggled with indexes down 5-10% year-to-date.

As you’ve probably read in the headlines, this was the worst first half of the year for the stock market since the 1970s! It’s true, but also right now it’s the timing that is unusual and not so much the decline itself. When 2022 started we were coming off three consecutive years of exceptionally strong stock market returns despite a global pandemic, economic shutdowns, and US political turmoil.

It’s the nature of markets to go up and down – within the context of a long-term uptrend – and bear markets are a part of that; in fact, this is the 15th bear market since 1947. Bear markets can often – but not always – signal that a broader economic recession will soon follow.

So, is the economy headed for recession…or maybe even there already? The answer is a definitive “maybe”. For now, the US jobs picture remains strong, consumers continue to spend, and corporate earnings are generally meeting or surpassing expectations. Of course, soaring inflation and recent events – the ongoing war in Ukraine and continuing Covid-related supply chain disruptions – have introduced doubts about prospects for earnings and growth. In June, the World Bank reduced its expectation for global growth in 2022 to 2.9%, down from 4.1% in January. In the US, projected growth has been cut to 2.6% from January’s 3.8%.

In many ways, the tough markets are reflective of a normal economic cycle playing out. We’ve been here before! A strong economy increases demand for goods and services which leads to inflation. The Federal Reserve tries to rein it in by raising interest rates, but not by so much that it causes a recession. And indeed, the Fed raised the federal funds rate in June by a larger-than-normal 0.75% while central banks around the world have also raised rates. Early signs show that these rate increases are indeed working to slow the economy. It is too soon to tell by how much, and whether it is enough to fight inflation.

We can’t say with certainty where markets will go next, but there are things we do know. Markets have survived some really crappy periods of history and have gone on to thrive and deliver significant returns to patient investors. We know that in down markets, the discipline of sticking with long-term strategies, while watching for opportunities to buy, has worked well for investors time and time again through the ages. And we know that many quality securities are priced much more attractively today than they were six months ago.

Investors Unite

A concerning decline in US democracy is coinciding with the recent downturn in the markets. We are deeply dismayed by the recent Supreme Court rulings eroding reproductive rights, gun safety laws, EPA enforcement, and the authority of key Federal Government agencies. As the government careens, the actions of other institutions and individuals, investors included, become ever more important. Figure 8 continues to exercise our voice – and your voice – as active shareholders with an agenda. Each year, engaged shareholders file proposals with companies asking them to address key environmental, social, and governance (ESG) issues by changing key corporate policies and practices. Most of these proposals go to a vote during the spring “proxy season” when most corporate annual meetings are held.

The power of the proxy has grown in recent years with an increasing number of resolutions filed and stronger investor support. This year, more than 500 ESG-related shareholder proposals have been filed, up more than 20% from a year ago (see graph to the right).

Here are some of the highlights from the 2022 proxy season:

Figure 8 was lead filer on a first-year proposal at TJX (parent of TJ Maxx and other retail chains) asking the company to adopt a Paid Sick Leave (PSL) policy for all employees. PSL is an important public safety measure and has been shown to increase workplace stability and productivity. PSL is also a matter of equity and racial justice: most of America’s low-wage workers and nearly half of all Black workers lack access to PSL. The PSL proposal at TJX received 33% support. While not a majority, this is a very strong result for a first-year resolution and enough to keep PSL on the negotiating table at TJX, which we intend to do.

Figure 8 voted proxies in support of these climate-related proposals: asking for the adoption of GHG emission reduction targets at Costco (received 70% support) and UPS (33% support); on climate lobbying and reporting on the physical risks of climate change at Google’s parent Alphabet, and on halting the financing of new fossil fuel development at all the major US banks (at most banks these proposals received more than 10% support; read more in this article from ICCR.)

Figure 8 also cast votes in support of improved global access to Covid 19 vaccines and drugs at Merck & Pfizer, on pay equity at Disney (59% support) and prevention of workplace harassment & discrimination at Starbucks (32% support).

We will keep you updated with news on changes to corporate policies and practices. Shareholder campaigns can take time – sometimes years – to see results. But very often, these votes do have impact. So watch this space! We are in this for the long term.