Quarterly Commentary 2Q’23

Recession…wait, what recession?

Here we are halfway through 2023, and we can confidently say the economy looks a whole lot better than it did a year ago. The recent US inflation reading came in at 3%, down from its high of 9.1% a year ago. It’s fair to say the Federal Reserve’s 10 rate increases over the past year have been successful in helping to reduce inflation without triggering a major slowdown (at least not yet). We are clearly not in recession at this point. While there have been some pockets of slowing — real estate, manufacturing, and tech sector hiring — overall GDP growth remains positive (estimated at 2.7% globally and 1.6% for the US) and the job market continues to exhibit exceptional strength. And while the vibe among consumers may not be good — inflation and higher interest rates are certainly causing angst — those same consumers sure are continuing to spend, especially on services and travel. The government and corporate sectors are spending, too, on infrastructure, climate initiatives, and on labor in this tight market.

All in all, we have good economic news: Inflation has come way down, interest rates have returned from near zero to near “normal”, and we’re not in recession. But there are still big questions around where we go next. Many seasoned economists believe the Fed has overshot by raising rates too aggressively and so are expecting a major recessionary slowdown in months ahead. As evidence, they point to classic signs of a coming recession – today’s significantly inverted yield curve and a notable decline in the Leading Economic Indicators index. Other equally seasoned economists believe we’ve entered a new era of persistent inflation, driven by forces like the urgent need for large-scale spending on climate solutions and the stubbornly low post-Covid labor force participation rate. That said, there are now a growing number of economists signing onto the most optimistic view – that we’re on our way to the proverbial soft landing, where we avoid recession entirely and see interest rates begin to come back down in 2024 – a view that has helped buoy the forward-looking stock market.

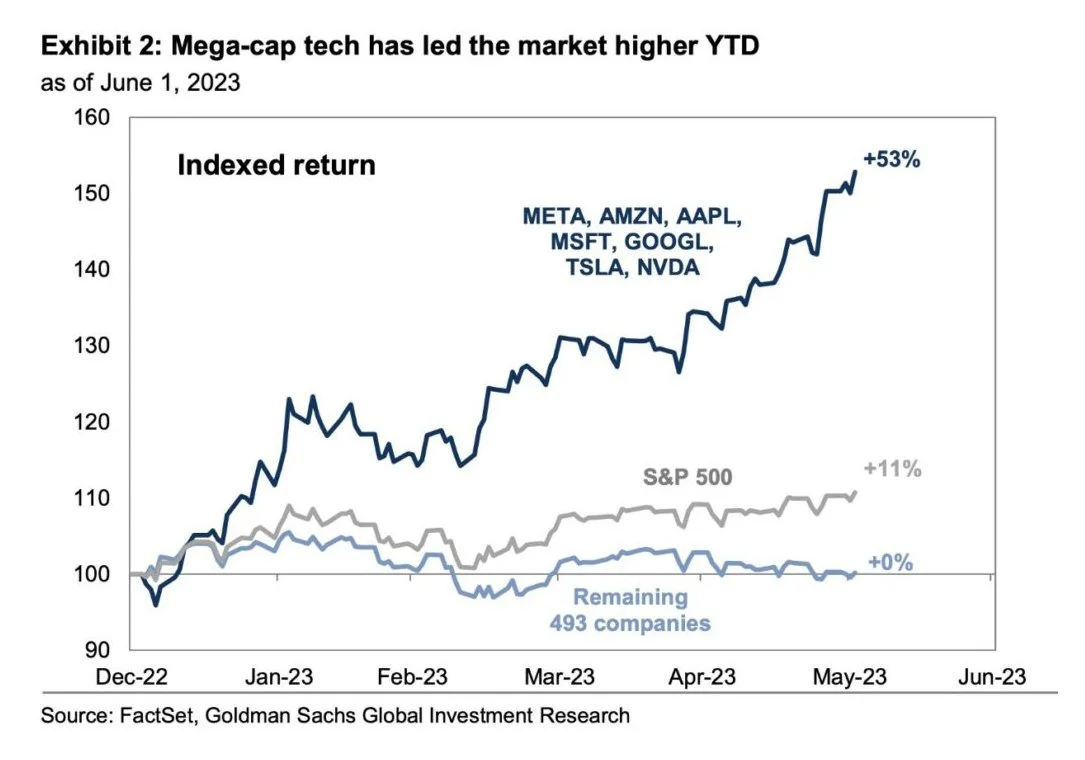

Markets do indeed appear to be onboard with the more optimistic scenarios. Through the 2nd Quarter, bond yields were mostly stable and stocks were largely up across geographies and sectors. The US-based S&P 500 was up 8.7% and the global MSCI ACWI up 6.4%*, while developed market international stocks along with the major US small and mid cap benchmarks were all up in the 3-5% range. It’s been a much better year for investors so far — but it’s also been a challenge for most investors to keep up with a select group of mega-cap US stocks that have delivered disproportionately strong returns so far in 2023. These stocks, now termed the “Magnificent 7” — Meta, Amazon, Apple, Microsoft, Google, Tesla and Nvidia — as a group are up 53% for the year. It’s notable that if you exclude those stocks, the rest of the S&P 500 was up only 4.1% during the 2nd quarter.

The strength of the Magnificent 7 has been in part due to a rebound following a rough 2022 (only two of the seven — Apple and Nvidia — have returned to their late 2021 highs) and in part propelled by optimism around recent leaps in generative AI. Investors see generative AI having tremendous potential for boosting productivity and easing labor pressures, advancing scientific research, and perhaps offering solutions to big societal challenges like climate change and wealth disparity. Generative AI almost certainly comes with unprecedented perils as well - and the world’s just starting to grapple with what those might be. We’re watching these developments closely.

Shareholder Meeting Season 2023

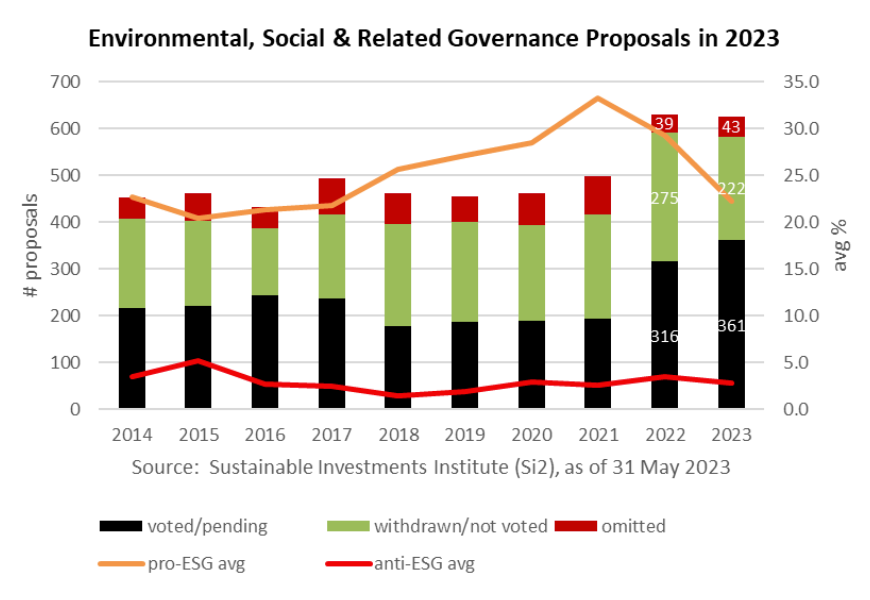

Every year, engaged shareholders file proposals with companies asking them to address corporate policies and practices around key environmental, social, and governance (ESG) issues. Many of these proposals go to a vote during the spring “proxy season” when most corporate annual meetings are held. Ideally, the shareholder proposal process leads to changes that align the long-term best interests of society, the planet, and shareholders. Some of the most meaningful progress happens behind the scenes, when productive engagements between shareholders and corporate executives result in shared agreements for action and withdrawal of the resolution.

So far in 2023, 620+ ESG-related proposals have been filed, with many resulting in exactly this type of agreement and withdrawal (see below for examples). In spite of the rising public attention to anti-ESG politicking, it’s clear that shareholder power around ESG initiatives is alive and well. Here are some highlights from Figure 8’s 2023 proxy season:

Figure 8 voted proxies on clients’ behalf at 151 companies this spring, including votes on 17 environment-focused proposals primarily around GHG emission reductions and the adoption of renewable energy. Of note: a climate resolution at Deere was withdrawn when the company committed to setting science-based GHG emission reduction targets aligned with keeping global warming to 1.5°C.

Figure 8 also cast votes on clients’ behalf on 84 proposals related to social issues including gender and racial pay gaps, preventing forced and child labor, and freedom of association for workers. There’s been progress on all those fronts, including pay gap proposals withdrawn at Amalgamated, Netflix, and Visa when the companies agree to disclose pay data by race and gender.

Figure 8 was again lead filer on a proposal at TJX (parent of TJ Maxx and other retail chains) asking the company to adopt a Paid Sick Leave (PSL) policy for all employees. PSL is an important public safety issue as well as a matter of equity and racial justice. The PSL proposal at TJX received 22% support this year. While not a majority and down from last year’s 33%, this is a strong result and enough to keep PSL on the negotiating table at TJX, which we intend to do.

We will keep you updated with news on changes to corporate policies and practices. Shareholder campaigns take time — sometimes years — to see results. But over the longer term these votes do have impact. So watch this space! We are in this for the long term.

You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.