Quarterly Commentary 3Q’23

Broad Economic Uncertainty (With a Nod to Workers)

The 3rd Quarter of 2023 was a challenging one for investors, marked by continuing uncertainty around inflation, concerns about eventual global economic slowdown, and ongoing fluctuations in interest rates. Shorter-term interest rates – largely determined by The Federal Reserve – were relatively stable during the quarter. The Fed instituted a 0.25% increase in the Federal Funds rate in July and none in September, noting that although the inflation outlook remains cloudy, the end of rate increases might be near. Longer-term interest rates, however, are largely influenced by institutional bond investors. During the 3rd Quarter, those bond investors saw enough new flags to sell longer-term bonds, pushing yields for 10-year Treasury bonds up nearly 1% in the 3rd quarter, from 3.7% to 4.6% - a big jump that’s added new questions about where rates go next. There are other factors that further complicate the outlook: dysfunction in the US Congress, rising US government deficits, war in Ukraine and now in the Middle East, and financial distress in China. It is a broadly uncertain time.

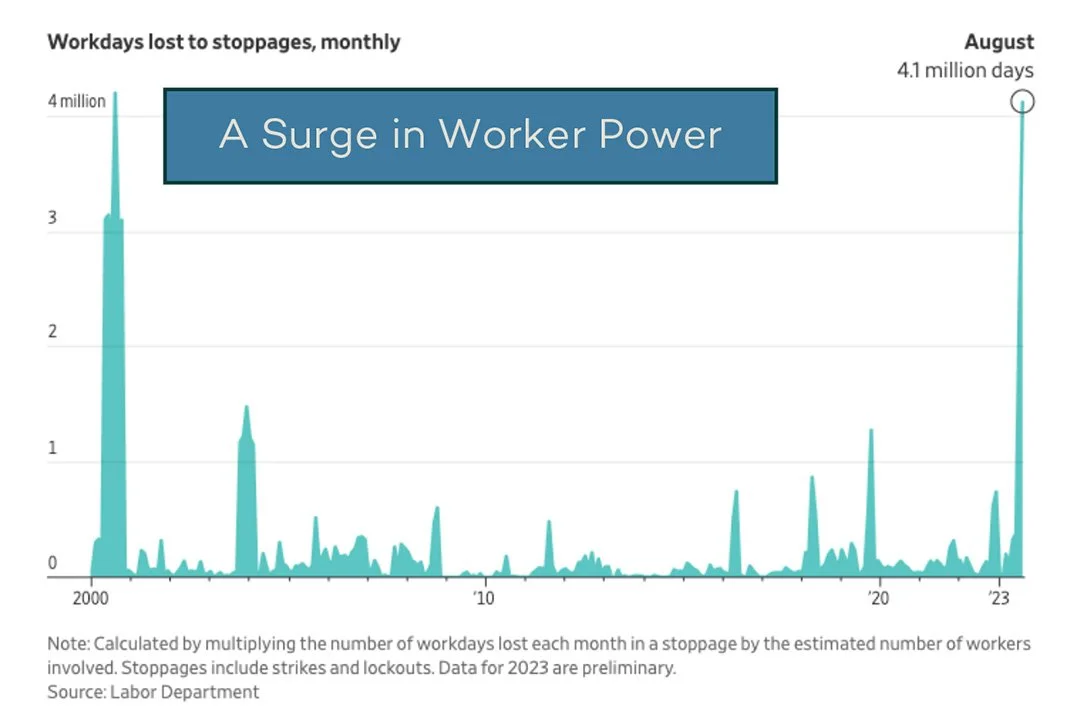

Meanwhile, workers are playing an increasingly important role in the ongoing inflation story. With labor shortages across the US and other countries, workers have new-found power – and they’re using it. After years of enduring wage growth that’s significantly lagged both executive pay and shareholder returns, workers are demanding higher pay, better working conditions, and an overall shift in how profits are allocated. Healthcare workers at Kaiser settled their recent strike with a 21% wage increase over four years, while striking members of the United Auto Workers are asking the top three automakers for a 36% wage increase for their next four-year contract. The Writers Guild of America recently settled a 146-day strike winning concessions that include annual compensation increases and protections around the use of artificial intelligence (AI). The Screen Actors Guild strike continues, where they are negotiating around an 11% increase in prices of new contracts, new revenue-sharing agreements, and additional AI protections.

Other labor unions are feeling and acting similarly empowered. This comes at a time when, in many industries, a changing technological landscape means we’ll need a different labor force with new skills to make things in new ways. The ongoing UAW strike is taking place within the context of car manufacturing moving towards EVs from traditional internal combustion engines. The SAG-AFTRA strike is grappling with the implications of generative AI for writers and actors. These are both excellent examples of the labor challenges ahead. There are some positive implications of these labor wins (and potential wins): they are helping to close the gap that’s persisted between top and average pay. Rising worker wages are a healthy and necessary structural shift for longer-term economic stability, but there is likely some pain associated with that shift.

Narrow Market Leadership (With a Pullback for Renewables)

The rising rate environment weighed on stocks in the 3rd Quarter. The S&P 500 and the global MSCI ACWI each returned -3.3%*, while small cap, mid cap, international developed and emerging market benchmarks all declined 4% or more for the quarter. Stocks lagged across almost every category other than the largest of ‘mega cap’ stocks. Markets experienced similar disparity from a sector perspective; for example, traditional energy stocks were up 11.3%, while utilities declined more than 10%.

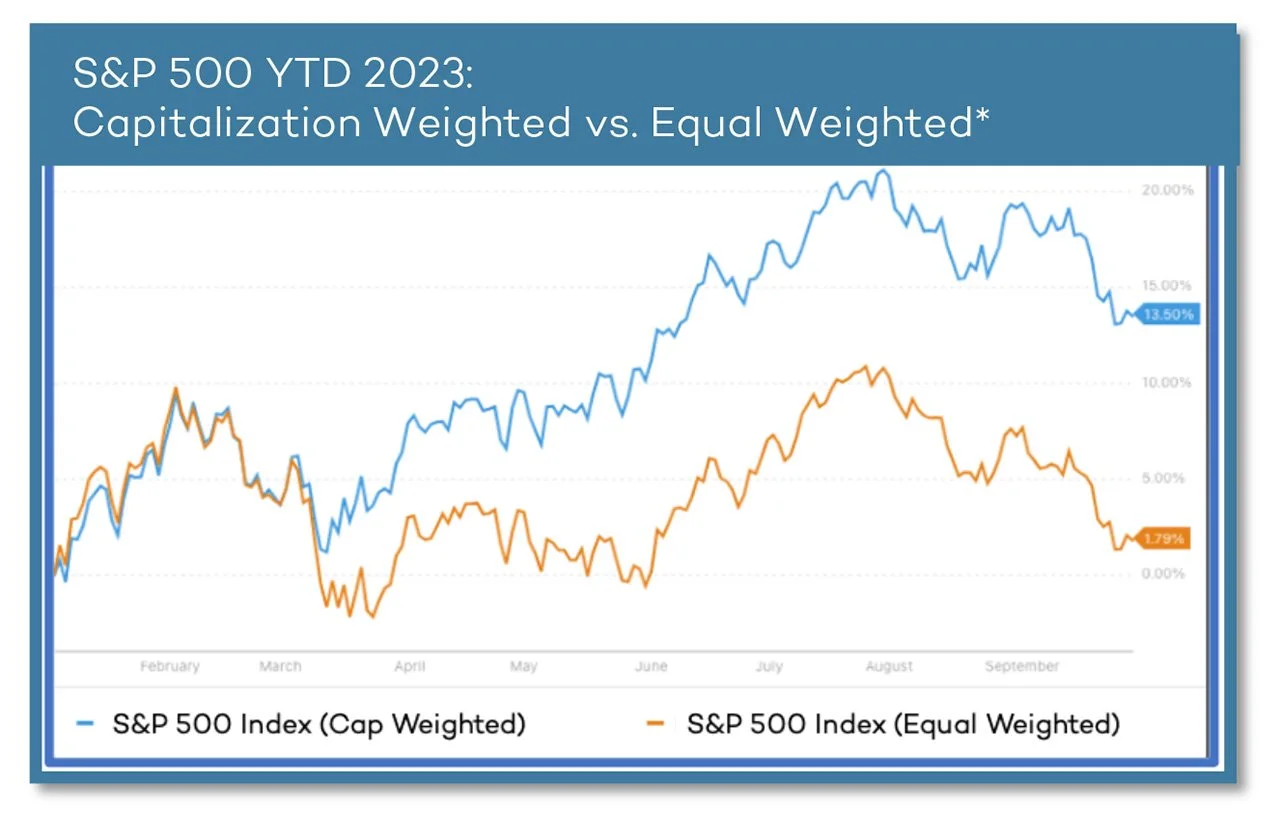

So far, 2023 has been a tough period for our stock portfolios. There are two primary reasons. First, unusually narrow market leadership has meant that gains have been concentrated among a handful of large company stocks. Mega cap stocks like the “Magnificent 7” (a term coined this year to describe Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla) have dramatically outperformed – so much so that their weight in “market cap weighted” benchmarks like the S&P 500 is exceptionally high. Right now, the largest 10 companies (of the S&P’s full 500) make up approximately 33% of the overall index. The chart at left emphasizes this point: if every stock in the S&P 500 were weighted equally, the year-to-date performance of the index drops from 13.5% down to 1.8%. This unusual level of concentration in the index has been a drag on our relative performance, especially given our management approach that emphasizes diversification.

The other major factor weighing on our stock portfolios is that rising interest

rates and overall economic uncertainty have combined to create a particularly volatile time for companies focusing on renewable energy technologies. These are, for the most part, smaller growth-focused companies with financing needs to build out their operations – and that makes them especially sensitive to rising interest rates. While oil and gas stocks have rallied on Saudi-led production cuts and supply-constraining global conflicts, renewable energy stocks like Solaredge,

NextEra Energy Partners, and Ameresco have struggled.

When it comes to the transition to renewable energy, our conviction remains. We are especially bullish on the buildout of solar electricity generation (which experts predict will double over the next three years in the U.S.), the adoption of electric vehicles as cars of the future, and a defacto (if not explicit) rise in the cost to emit carbon given regulations like the EU’s Carbon Adjustment Mechanism. This is a large- scale transition with a rapidly shifting landscape and there are bound to be bumps. Against this backdrop, we’re sticking to disciplines, remaining patient, and watching for buying opportunities as investors committed to creating a more sustainable economy.

* Source for Stock Index Returns: Refinitiv DatastreamYou should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.